Technological progress has always been the guiding light in the world of financial services, just like many other activities we’re so used to.

Currently, the industry of financial technology and fintech solution providers, such as Yalantis, is definitely on the rise. Its market value has almost doubled in recent four years and is expected to grow even further by the end of the current year.

A vast majority of US citizens nowadays consider financial technology applications to be a part of their everyday lives. They use such applications for various financial transactions, from ordering online to paying bills.

In this article, we will look at the most prominent fintech marketing strategies in 2024. However, to approach this topic, we must first clarify what marketing for fintech is.

Table of Contents

What’s fintech marketing?

For the most part, financial technology marketing can be described as a selection of practices that ensure the constant growth, development, and automation of financial services and their provision to clients.

Fintech marketing has many applications, among them enhancing traffic, strengthening enterprise growth, and improving client loyalty levels.

So, what are the ways in which financial technology marketing improves your relationships with clients?

Widens the audience: the first and foremost task of any fintech digital marketing campaign is to engage new clients all around the world. The possibilities are endless here, and smart research and preparations will allow an enterprise to explore levels of engagement never seen before.

Make a bond: the more you provide transparent and reliable information about the intricacies of the financial world to your clients, the more they begin to trust you. With time, such trust can evolve into deeper bonds, giving the enterprise ultra-high loyalty.

Know your customer: fintech players are on the market to satisfy the final customer’s requirements. In order to do that, it is essential to learn what they need. The content you include in your marketing campaign must be adjusted accordingly.

Okay, now that we clarified the basics, it is time to get deeper into the topic of the best modern fintech marketing strategies.

What fintech marketing strategies to use in 2024?

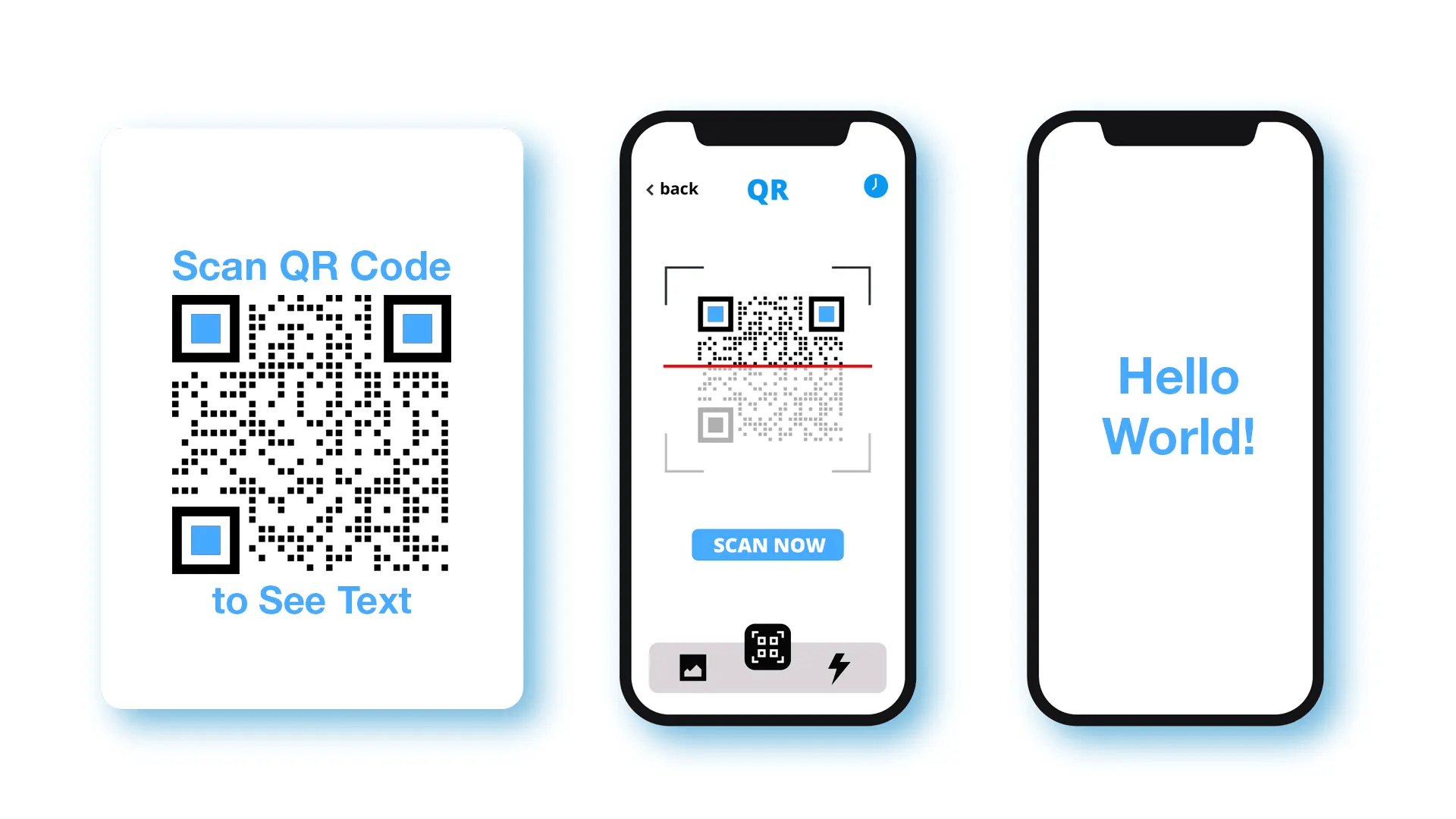

![Fintech Marketing In [Year]: Trends, Ideas, And Strategies 1 Word Image 82469 2 |](https://techengage.com/wp-content/uploads/2022/06/word-image-82469-2.jpeg) There are several major strategy trends in 2024 for fintech marketing, and we will begin with the most obvious one

There are several major strategy trends in 2024 for fintech marketing, and we will begin with the most obvious one

SMM (Social Media Marketing)

Social media still rules the masses unquestionably. An average modern US citizen can spend up to 2,5 hours a day on social media, according to Statista. It would be a tremendous waste not to use such a profound source of a new audience.

To attract new clients with SMM, you’d need a well-thought-out content strategy, both engaging and attractive. The content doesn’t have to be too elaborate; sometimes, a short but smart tweet would go a long way toward your potential audience.

But before you even start with the content, it’s crucial to understand your audience, which social media they tend to use, and what kind of content they prefer.

Gamification

Gamification is just what it sounds like: introducing game elements into a strategy.

What makes gamification an exceptionally great tool to use as a part of a fintech marketing strategy is that it’s both engaging and educational at the same time.

It can simultaneously increase customers’ financial literacy, making them feel more comfortable while managing their finances, and help them save money by setting specific goals. All this will lead to a great increase in customer loyalty.

Besides, gamification tends to create unity between customers of a particular establishment, and as a result, customers tend to recommend this establishment to their friends and relatives much more often.

The app Honeygain is an excellent example of how gamification can be used in fintech marketing. It allows users to share unused internet data and earn rewards in return. Honeygain uses game-like features to engage users, such as progress bars and achievement badges.

In addition to its gamification features, Honeygain is also an educational tool. It can help increase customers’ financial literacy by encouraging them to use their internet data more efficiently, ultimately saving them money on their internet bills.

Online advertising

When planning the advertising campaign for a fintech product, it is important to take modern reality into consideration. Any manager that ignores the prevalent role of the online presence of the audience would miss a considerable share of it.

Investing in advertising campaigns on huge online platforms (such as Youtube and Facebook) is as important nowadays as TV and radio advertising was during the past century. Online platforms speak today’s language; they use the imagery and verbal means that the potential audience most likely does. Moreover, they create all that.

So make sure to learn it and use it in your marketing campaign to maximize its efficiency.

Okay, we’ve covered the main elements of a thriving fintech marketing campaign in 2024; now, let’s get to the most critical trends in the industry.

Most useful trends in fintech marketing in 2024

All the trends we will cover below have one thing in common: to make your product/service stand out. The market is far from saturation, of course, but many products and services are out there, and any new contender would face fierce competition.

With that in mind, let’s get to fintech trends 2024.

Fintech branding

Let’s imagine you’re taking your new financial service on the market. Chances are, there are at least ten (more, probably) products out there that offer comparable services.

To succeed in such an environment, you need to make yours a brand and make it memorable. Build assets that scream “your service” each time someone interacts with them.

Create effective mobile experiences

Speed and efficiency are the names of the game when it comes to fintech services. People would not waste time trying to access your mobile app in case something goes wrong; they would delete it instantly and go to the next thing.

That is why making your customers’ mobile experience as comfortable and smooth as possible is essential.

Provide content with real value

It is not enough for content to be entertaining nowadays. The modern world overflows with entertainment; it jumps on you from behind every corner. Your audience is most likely oversaturated with simple entertainment, and you would need something more profound to grab their attention and earn their trust later.

Provide content with real value — information that can teach your audience something that can be useful in everyday life. Most importantly, provide helpful information about the financial world so that your customers can feel more confident, and that feeling will work wonders for your relationships.

Some final thoughts on the matter

Trying to maintain the balance between creating bonds with your customers, educating them, and engaging wider audiences might be demanding, especially in the complex technological environment of fintech. That makes marketing strategy especially important for any fintech player that wishes to succeed in the industry. Pay it enough attention and resources, and it will pay back manyfold.

Share Your Thoughts